Current Gold Price: Real-Time Rates & Trends

Current Live Price: $4602.63/ oz | Sell | Calculator

Are you looking for the current gold price and seeking answers as to why the gold price goes up or down? Most likely, you are considering buying or selling gold and understand the significance of being informed about its current value. While gold is typically traded in ounces and kilograms, it is also commonly traded in grams or pennyweight, which are the most important units of weight for consumers.

At our company, we strive to provide the most up-to-date gold price by frequently sourcing price-information from reputable sources, such as the Comex, London OTC market, and Shanghai Gold Exchange. Our gold calculator is the ultimate tool to check the current price in real-time.

Factors influencing the current gold price – daily & right now

There are various factors that can significantly impact the current price of gold. The top three reasons why the gold price is moving are the current global economy, the strength of the US dollar, and the combination of inflation expectations and interest rates.

One of the most influential factors is the global economic and political climate. Investors tend to turn to gold as a safe-haven investment during times of uncertainty or market volatility, which can cause the demand for gold to increase and drive the price. Unexpected events, such as the outbreak of a war involving a G7 nation or a major western economy, can greatly impact the price of gold.

Another key factor is the strength of the US dollar. Gold is priced in dollars, so when the dollar weakens, it becomes cheaper for buyers, making gold more attractive and potentially driving up its price.

In addition, the level of inflation (plus inflationary risks) and interest rates also play a significant role. Lower interest rates tend to make gold more appealing leading to an increase in demand and prices. Higher interest rates, though, may put pressure on the current gold price usually leading to lower prices.

Gold Chart Analysis

An effective method for understanding both the current and projected gold prices is to examine charts. By analyzing the 30-day, 60-day, 12-month, and 5-year charts, one can gain valuable insight into the potential movement of the gold price. Throughout history, gold has followed a stair-like pattern, allowing one to understand its potential behavior in the coming months.

2024 – The Year of The Gold Bulls

The year 2024 was truly a “golden year,” with gold braking one record after another. Thanks to a combination of reduced inflation concerns and interest rate cuts, gold successfully outperformed most investments. Performance in 2024: approx. +26%

The 5 Year Gold Chart

For approximately four years, gold maintained a trading range between $1,600 and $2,000 before finally breaking out of this range in the first quarter of 2024. It is highly unlikely that gold will ever fall below the $2,000 mark per ounce again.

Long Term Gold Chart (10 Years)

Gold follows a cyclical pattern, moving in stages. It is most likely that this trend will continue, as history tends to repeat. Once gold reached a new peak, it is likely to remain in a trading range for a few years before breaking out once again.

Projected Gold Prices for 2025 and 2026

In 2024, gold made a bold move by experiencing a significant 26% increase in its value. The reDollar trading division anticipates continued growth and high gold prices in 2025 and 2026, with a strong likelihood of reaching new all-time highs.

However, we do not expect to see another significant rally in the near future. While we have confidence in the potential of gold, we do not foresee it topping $3,000 per ounce, and if it does, it will likely only be for a brief period of time. Looking ahead to 2025 and 2026, we expect to see gold trading within the range of $2,600 to $3,000.

The Impact on You as a Retail Investor or Consumer

It may be commonly believed that only traders or insiders are able to earn profits during a gold bull market. Fortunately, this is not entirely true. Many Americans have a great opportunity to take advantage of the high gold price.

According to the World Gold Council, approximately 14% of American households own some form of gold (items of little monetary value such as gold-plated or gold-filled items are not included), whether it may be jewelry, coins, bars, medals, or other merchandise made of at least 41.7% pure gold.

Besides gold, a significant percentage of American households also own something made of silver and because the silver price is usually moving up along with gold, this may open up another opportunity. Take a look at your jewelry box. Is there probably something broken, mismatched, or old fashioned that you may not wear anymore? As a result of the high gold price, private individuals have the opportunity to cash out big. Some may be able to get more money for the merchandise they turn in than they initially paid for.

What Moved The Gold Price in The Past?

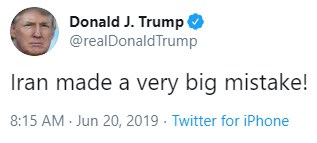

President Trump Sends Gold on a Boost Just by Tweeting

First, let’s get back to the initial question of what impacts the price of gold. We mentioned political decisions as a major factor. It was mid-August 2019 when China announced new tariffs, leading President Trump to post a series of comments on Twitter that caused the markets to shatter. The price of gold jumped almost $50 in just hours.

Brexit, YES to Leaving the European Union

In Great Britain, a referendum was held on June 23, 2016 about whether the UK should stay in or leave the European Union. When officials announced that voters opted to leave, the gold price went through the roof. The uncertainty connected with the decision to break with Brussels led to a market crash, and the fear that other countries might follow the UK out of the Union brought the gold price to a boil. Such decisions with far-reaching consequences have a direct impact on the current gold price.

New Sanctions on Iran

After the announcement that the United States would put more sanctions on Iran and Iranian leaders, the gold price rose again—by almost 5% in just hours. That was mid-August 2019. Iran’s foreign minister, Mohammed Sarif, and religious leader Ajatollah Ali Chamenei were also personally punished with financial restrictions by the US, causing fears that the conflict could even result in war. Sometimes, harsh rhetoric and threats are enough to push the current gold price.

The Financial Crisis of 2008

In 2008, when the markets collapsed and the real estate crisis reached its peak, financial institutions, banks, insurance companies, national banks, and private individuals had just one thing in mind: GOLD. It was the only commodity people and enterprises were willing to trust, sending the gold price on a year-long rally. From 2008/2009 to 2011, the gold price went up from less than $1,000 to almost $2,000 per ounce.

Other Gold Price Influences

Inflation, interest rates, the US dollar, and even the price of oil are all impacting the current gold price. You might be surprised to learn that if we look at the last 10 years, the jewelry industry has had the smallest impact on the price of gold. Jewelry makers struggled with the high gold prices, as they made merchandise more expensive and caused many businesses to shift to silver for making jewelry. The demand for jewelry, especially in countries like Turkey, India, and Saudi Arabia, decreased, while the demand for coins and bars shot through the roof.

Current Gold Price

Besides from oil, gold is one of the most widely discussed commodities. Everyday, there are conversations among consumers, investors, and officials about its demand, price manipulation, and availability.

The rise or fall of gold prices typically tied to strong emotions and lead to intense discussions. People often question if the drop in price is natural, or if it is caused by government interference, speculation or even manipulation. Conspiracy theories often circulate when discussing the current gold price.

Gold is traded not only at the New York Stock Exchange, but also at other major stock exchanges around the world, such as Hong Kong, Zurich, and London. However, the New York Stock Exchange is considered the most significant for gold trading, and the trading volume directly impacts the current gold price.

Current Gold Price Per Ounce

Right now, the current gold price per ounce is $1,322.33. Traders and speculators talk about the price in ounces because it’s the most common unit of weight for gold. All over the world, miners and traders are using troy ounces to measure the weight of gold. Moreover, many gold products like coins or bars weigh or contain exactly one troy ounce of pure gold.

Thus, most people refer to the gold price per ounce if they’re talking about buying or selling gold bullion. For smaller quantities, grams or pennyweight are more useful weight units, as they allow for a more accurate calculation of the current gold value. In the US, we trade gold in US dollars. However, gold is traded in euros in Europe and in Hong Kong dollars in Hong Kong.

- Current gold price per ounce for 24K gold: $4602.63

- Current gold price per ounce for 18K gold: $3455.43

- Current gold price per ounce for 14K gold: $2686.02

Current Gold Price Per Pennyweight (dwt.)

When people talk about the current gold price in pennyweight (short: dwt.), they’re usually talking about jewelry or scrap gold. But it’s also a geographical thing. While the term “pennyweight” is most common in Florida, states like California and Nevada only use grams. Other states like New York are using both weight units, grams and pennyweight, which can also lead to confusion.

Only the weight of jewelry or scrap gold will be described in pennyweight. It’s very unusual to express the current gold price for bullion per pennyweight.

- Current gold price per dwt. for 24K gold: $229.39

- Current gold price per dwt. for 18K gold: $172.22

- Current gold price per dwt. for 14K gold: $133.87

Current Gold Price Per Gram

The vast majority of people use grams over pennyweight as a weight unit for their gold. Most digital scales are preset to grams as their standard unit of weight. Most appraisers, gold buyers, and miners also use grams, as it’s just more accurate. A quick look at jewelry descriptions of the two most famous auction houses for fine jewelry, Christie’s and Sotheby’s, makes it clear that grams are also most commonly used by the world’s leading jewelry appraisers.

Want to weigh your gold products in grams? We have a great basic $5 scale for sale, making it very easy to check the weight of your item.

- Current gold price per gram for 24K gold: $147.99

- Current gold price per gram for 18K gold: $111.11

- Current gold price per gram for 14K gold: $86.37